Detached House 129 Cove Cres, Hamilton, ON, Sale Price $785,000, List Price $799,900, Sold 7 days from Date of Posting on Homes.pk, 3 Bed, 2 Bath, 700–1101 sqft,X8099324 • RE/MAX Escarpment Golfi Realty Inc. Zoocasa

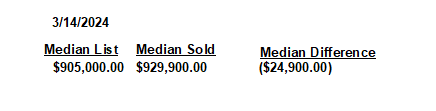

Hamilton Stats

Impact of Rising Interest Rates on Hamilton and Burlington Real Estate Markets

Prospective homebuyers and sellers in Hamilton and Burlington are feeling the effects of higher interest rates, which have led to a slowdown in sales activity across the country. With the Bank of Canada possibly halting its rate hikes, fixed-rate mortgages have reached six per cent nationwide, resulting in elevated borrowing costs. This trend has particularly affected the Hamilton and Burlington real estate markets, where demand has softened.

In October, residential property sales in Hamilton dropped over 12 per cent year-over-year to 408 units, while Burlington saw a nearly 20 per cent decline to 137 units, according to data from the REALTORS® Association of Hamilton and Burlington (RAHB). Despite reduced transactions, home prices have remained stable, with Burlington’s average price increasing six per cent annually to $1.159 million, while Hamilton’s average remained flat at $789,040.

The higher lending rates have prompted more homeowners to list their properties, leading to an increase in new listings, particularly in higher price segments. Nicolas von Bredow, President of RAHB, notes that housing inventory levels have surged in both Hamilton and Burlington, reaching their highest levels since 2011. This increase in supply, coupled with robust housing construction activity, suggests a shifting landscape in the real estate markets of these cities.

Looking ahead to 2024, the RE/MAX Housing Market Outlook (HMO) report predicts continued strength in both Hamilton and Burlington. Hamilton’s prices are forecasted to rise by 3.5 per cent, with a two per cent increase in home sales, while Burlington is expected to see a four per cent price surge and a three per cent rise in sales activity. Conrad Zurini, a broker at RE/MAX Escarpment Realty Inc., highlights a growing trend of first-time homebuyers pursuing alternative ownership options, such as co-buying with friends or family, which is expected to persist in the coming year.

Notably, condominiums in Burlington may experience notable demand, despite a mixed performance in October. While condo sales in Burlington declined year-over-year, benchmark prices saw a three per cent increase, reaching over $622,000. In Hamilton, condo sales rose, but prices dropped by six per cent to approximately $490,000. The RE/MAX HMO emphasizes that single-family homes are likely to drive growth in Hamilton, with detached home sales remaining strong despite a decrease in October.

As for the possibility of interest rate cuts, the Bank of Canada has indicated that high rates will persist until inflation returns to its target rate, possibly not until 2025. However, some economists speculate that rate cuts could occur in early 2024 to counterbalance the cooling housing market. Stephen Brown of Capital Economics suggests that a decline in house prices could prompt the Bank of Canada to adjust its monetary policy sooner than anticipated.

While the real estate market plays a significant role in Canada’s economy, representing approximately 40 per cent of the GDP, any downturn could have widespread implications. Despite desires for a housing market downturn among younger generations, the potential impact on the broader economic landscape underscores the importance of carefully navigating changes in the real estate sector.